- Volume 59 , Number 4

- Page: 726–8

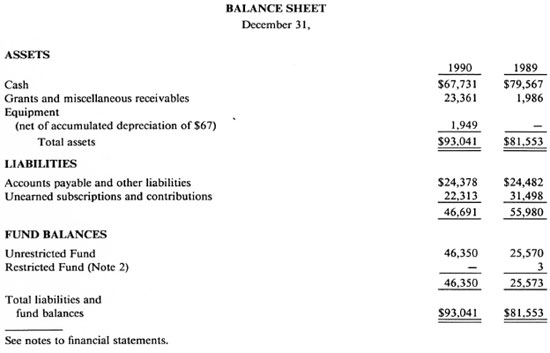

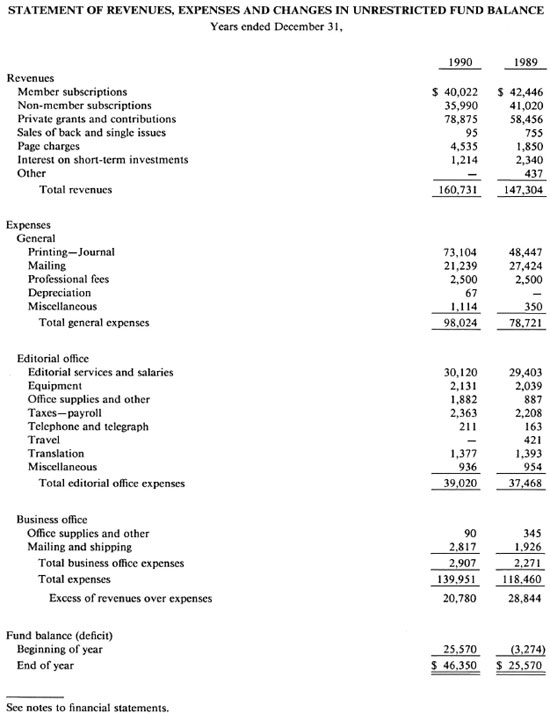

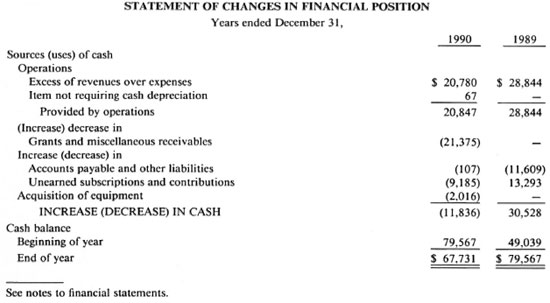

Statement of Financial Condition

Tail, Weller & Baker, Certified Public Accountants, New York, Auditors, INTERNATIONAL JOURNAL OF LEPROSY, on 15 March 1991 transmitted the following audited financial statements for 1990 to the Board of Directors, UL, with the following report:

"We have audited the accompanying balance sheets of the INTERNATIONAL JOURNAL OF LEPROSY of the International Leprosy Association as of December 31, 1990 and 1989, and the related statements of revenues, expenses and changes in unrestricted fund balance, and changes in financial position for the years then ended. These financial statements are the responsibility of the organization's management. Our responsibility is to express an opinion on these financial statements based on our audits.

"We conducted our audits in accordance with generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements arc free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

"In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the INTERNATIONAL JOURNAL OF LEPROSY of the International Leprosy Association as of December 31, 1990 and 1989, and the results of its operations, the changes in its fund balances, and the changes in its financial position for the years then ended, in conformity with generally accepted accounting principles."

NOTES TO FINANCIAL STATEMENTS

December 31, 1990 and 1989

NOTE 1 -SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PREPARATION

The financial statements have been prepared on the accrual basis and, as such, income from subscriptions to the "International Journal of Leprosy" is recognized ratably over the term of the subscriptions.

EQUIPMENT

Equipment is carried at cost. Depreciation is provided on a straight-line basis over the lives of the assets which is five years.

INCOME TAX

The Organization continues to qualify as a non-taxable organization under Section 501(c)(3) of the Internal Revenue Code. Therefore, no provision for income tax is necessary.

NOTE 2 -RESTRICTED FUND

On May 11, 1976, the Lani Booth Fund contributed $25,000 for the printing and distribution of a cumulative index of the first forty volumes of the "International Journal of Leprosy." Expenses incurred in the production of the index were $25,000 and $24,997 for the years ended 1990 and 1989, respectively.

NOTE 3-DONATED SERVICES

ALM International has provided administrative and secretarial support and occupancy space to the organization. No amounts have been reflected in the statements for these services. The estimated values for these services arc approximately $9,000 for each of the years ended 1990 and 1989.