- Volume 67 , Number 3

- Page: 366–9

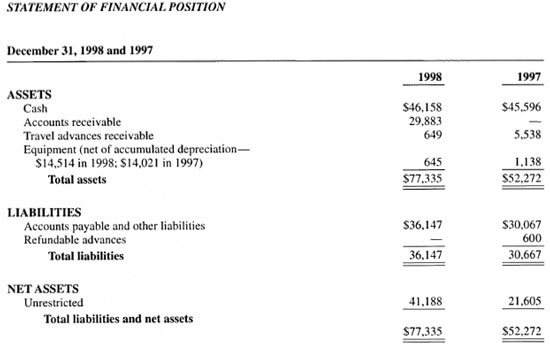

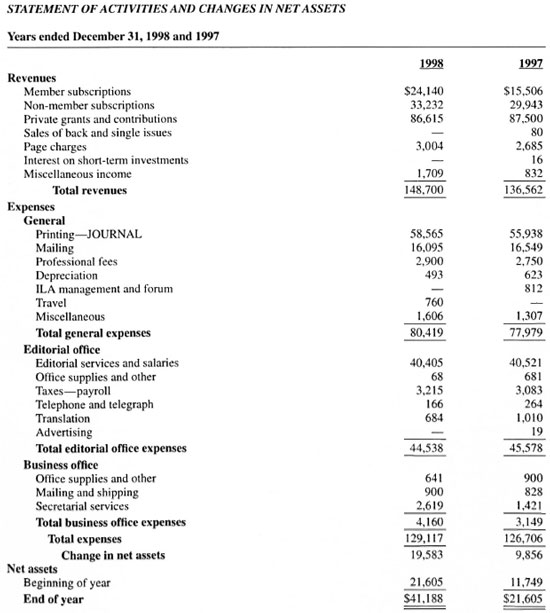

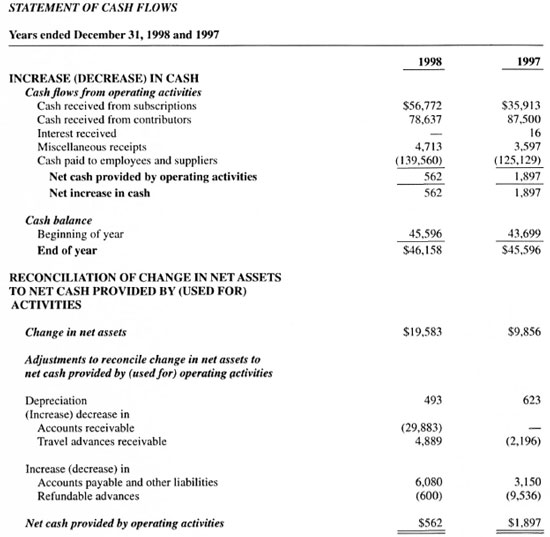

Statement of Financial Condition

Tait, Weller & Baker, Certified Public Accountants, New York, New York, Auditors, International Journal of Leprosy, on 20 February 1999, transmitted the following audited financial statements for 1998 to the Board of Directors, IJL, with the following report:

"We have audited the accompanying statements of financial position of the International Journal of Leprosy of the International Leprosy Association as of December 31. 1998 and 1997, and the related statements of activities and changes in net assets, and cash flows for the years then ended. These financial statements are the responsibility of the organization's management. Our responsibility is to express an opinion on these financial statements based on our audits.

"We conducted our audits in accordance with generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

"In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the International Journal of Leprosy of the International Leprosy Association as of December 31. 1998 and 1997, and the changes in ils net assets and its cash flows for the years then ended, in conformity with generally accepted accounting principles."

NOTES TO FINANCIAL STATEMENTS

December 31,1998 and 1997

(1) SUMMARY OK SIGNIFICANT ACCOUNTING POLICIES

ORGANIZATION AND PURPOSE

The International Journal of Leprosy of the International Leprosy Association ("IJL") qualities as a non-taxable organization under Section 501(c)(3) of the Internal Revenue Code.

The primary purpose of IJL is to publish and distribute the "International Journal of Leprosy."

BASIS OF PREPARATION

IJL prepares its financial statements on the accrual basis and, as such, income from subscriptions to the "International Journal of Leprosy" is recognized ratably over the term of the subscriptions.

ACCOUNTING ESTIMATES

In preparing financial statements in conformity with generally accepted accounting principles, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reported period. Actual results could dif fer from those estimates.

EQUIPMENT

Equipment is carried at cost. Depreciation is provided on a straight-line basis over the lives of the assets which is five years.

(2) DONATED SERVICES

ALM International has provided administrative and secretarial support and occupancy space to the organization. No amounts have been reflected in the statements for these services. The estimated values for these services are approximately $10.000 for each of the years 1998 and 1997. respectively.