- Volume 63 , Number 3

- Page: 502–5

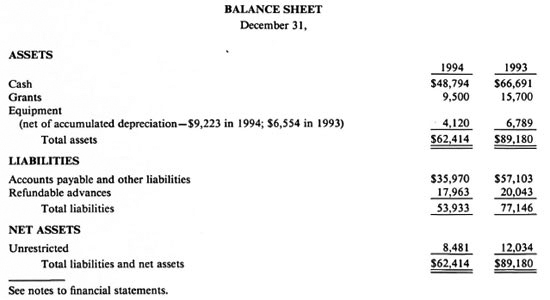

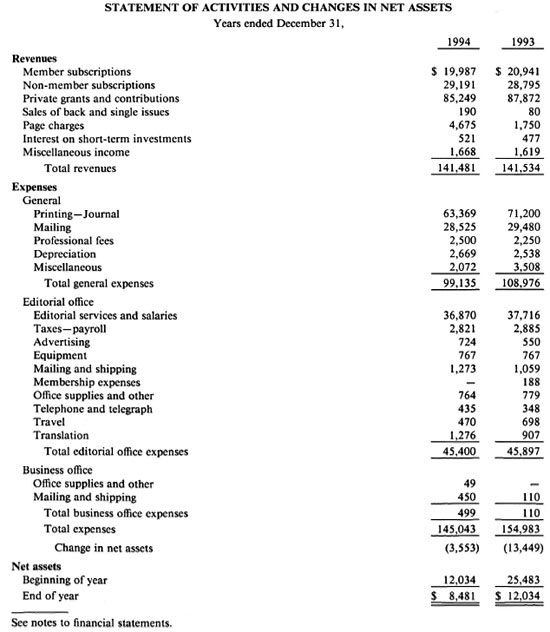

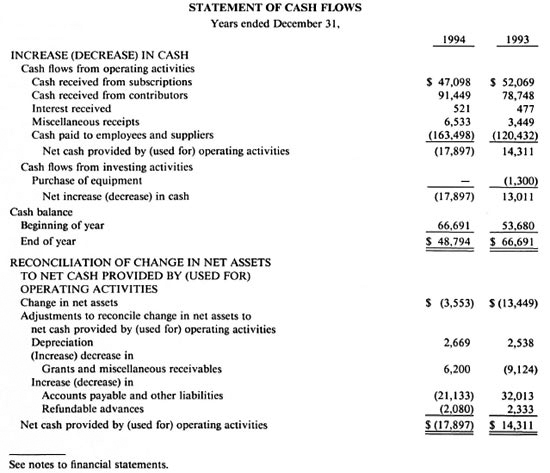

Statement of financial condition

Tait, Weller & Baker, Certified Public Accountants, New York, Auditors, International journal of leprosy, on 1 March 1995, transmitted the following audited financial statements for 1994 to the Board of Directors, IJL , with the following report:

"We have audited the accompanying statements of financial position of the International journal of leprosy of the International Leprosy Association as of December 31, 1994 and 1993, and the related statements of activities and changes in net assets, and cash flows for the years then ended. These financial statements are the responsibility of the organization's management. Our responsibility is to express an opinion on these financial statements based on our audits.

"We conducted our audits in accordance with generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

"In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the International journal of leprosy of the International Leprosy Association as of December 31, 1994 and 1993, and the results of its operations, the changes in its net assets, and its cash flows for the years then ended, in conformity with generally accepted accounting principles."

NOTES TO FINANCIAL STATEMENTS

December 31, 1994 and 1993

(1) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

ORGANIZATION AND PURPOSE

The International journal of leprosy of the International Leprosy Association ("IJL") qualifies as a non-taxable organization under Section 501(c)(3) of the Internal Revenue Code.

The primary purpose of IJL is to publish and distribute the "International Journal of Leprosy."

BASIS OF PREPARATION

IJL prepares its financial statements on the accrual basis and, as such income from subscriptions to the "International Journal of Leprosy" is recognized ratably over the term of the subscriptions.

EQUIPMENT

Equipment is carried at cost. Depreciation is provided on a straight-line basis over the lives of the assets which is five years.

OTHER

IJL has elected early adoption of Statement No. 116, "Accounting for Contributions Received and Contributions Made" and Statement No. 117, "Financial Statements of Not-for-Profu Organizations," issued by the Financial Accounting Standards Board, which are effective for fiscal years beginning after December 15, 1994. Financial statements for the prior years have not been re-stated and it was determined that there was no cumulative effect for the accounting change on prior year changes in net assets.

2) DONATED SERVICES

ALM International has provided administrative and secretarial support and occupancy space to the organization. No amounts have been reflected in the statements for these services. The estimated values for these services are approximately $10,000 for each of the years 1994 and 1993, respectively.